2026 में financial markets में technology adoption तेजी से बढ़ रहा है, और इसी वजह से automated trading software एक बेहद popular topic बन चुका है। चाहे stocks हों, forex हो या cryptocurrency — traders अब manual execution के बजाय automation solutions की ओर बढ़ रहे हैं।

लेकिन सबसे पहले एक बेहद महत्वपूर्ण और honest reality check:

👉 Automated trading = Guaranteed profit नहीं।

👉 Software केवल rules execute करता है, market unpredictability खत्म नहीं करता।

👉 Risk management अभी भी critical रहता है।

इस article में हम practical, safe और realistic तरीके से पूरी picture समझेंगे।

Automated Trading Software क्या होता है?

Simple शब्दों में:

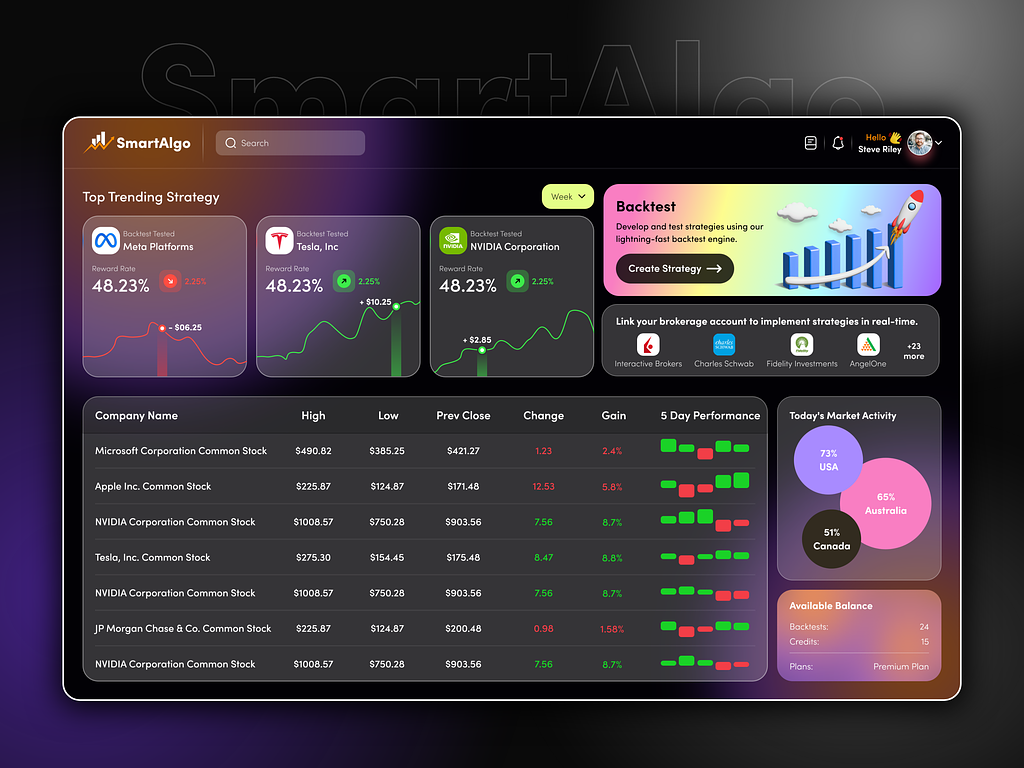

✔ Predefined strategies

✔ Algorithmic rules

✔ Auto buy/sell execution

✔ Emotion-free trading

यानी आप logic सेट करते हैं, software trades execute करता है।

Automated Trading क्यों Popular हो रहा है?

Automation के मुख्य कारण:

✅ Emotionless decisions

✅ Faster execution

✅ Strategy consistency

✅ Backtesting possibilities

✅ Multi-market monitoring

✅ Time efficiency

लेकिन गलत setup → तेज़ losses भी संभव।

Automated Trading Software Free – Reality Check

बहुत लोग खोजते हैं:

automated trading software free

Important clarity:

👉 Truly “free profitable bots” rare होते हैं

👉 Free tools अक्सर limited features देते हैं

👉 Hidden risks / trial traps possible

Free ≠ Risk-free।

Automated Trading Software India – Special Considerations

भारत में automation ecosystem unique है:

✔ Regulatory compliance matters

✔ Broker integration required

✔ API access needed

✔ Strategy validation critical

Indian markets highly dynamic होते हैं।

Automated Trading Software for Indian Stock Market

Indian stock market automation typically involves:

✔ Broker APIs

✔ Strategy engines

✔ Execution modules

✔ Risk filters

लेकिन:

❌ Blind bot usage dangerous

✔ Testing अनिवार्य

Automated Trading Software for Zerodha – Common Query

एक बेहद common search है:

automated trading software for Zerodha

Practical understanding:

✔ Zerodha APIs allow automation

✔ Third-party tools integrate कर सकते हैं

✔ Strategy logic user-dependent

लेकिन हमेशा broker policies & compliance समझें।

Automated Trading Software for Stocks

Stocks automation use cases:

✔ Intraday strategies

✔ Breakout systems

✔ Mean reversion models

✔ Risk-controlled execution

Software rules follow करता है — judgement नहीं।

Automated Trading Software Forex

Forex markets में automation popular है:

✔ 24/5 market nature

✔ High volatility

✔ Algorithmic strategies common

लेकिन forex = High risk domain।

Automated Trading Software for Cryptocurrency

Crypto automation searches rapidly बढ़े हैं:

automated trading software for cryptocurrency

Reasons:

✔ 24/7 market

✔ Rapid price movement

✔ Arbitrage strategies

✔ Bot-friendly ecosystem

लेकिन volatility extreme।

Automated Trading Software Cryptocurrency Risks

Critical risks:

❌ Sudden crashes

❌ Liquidity traps

❌ Exchange risks

❌ Strategy failure

Automation risk eliminate नहीं करता।

Automated Trading Software Reddit – Why Popular?

Searches जैसे:

automated trading software reddit

क्योंकि:

✔ Users real अनुभव साझा करते हैं

✔ Success + failure दोनों दिखते हैं

✔ Overhyped claims exposed होते हैं

लेकिन हर advice reliable नहीं।

Automated Trading Software South Africa / Global Interest

Automation interest global है:

✔ automated trading software south africa

✔ International forex & crypto adoption

✔ Similar risk dynamics worldwide

Markets अलग, risks similar।

How Automated Trading Actually Works (Core Logic)

Basic flow:

Strategy Rules → Market Data → Signal → Execution → Risk Control

Software केवल instructions follow करता है।

Major Advantages of Automated Trading

✅ No emotional bias

✅ Faster execution

✅ Consistent strategy

✅ Multi-asset capability

✅ Backtesting possible

✅ Time saving

Disadvantages / Hidden Risks

❌ Strategy failure risk

❌ Over-optimization danger

❌ Technical glitches

❌ Market regime changes

❌ No human intuition

❌ Loss acceleration possible

Automation गलत logic amplify कर सकता है।

smart Safety Principles (Critical Section)

Experts हमेशा follow करते हैं:

✔ Backtesting before live trading

✔ Paper trading / simulation

✔ Strict risk management

✔ Stop-loss integration

✔ Capital protection priority

✔ Continuous monitoring

“Set & forget” approach risky।

Biggest Beginner Mistakes

❌ Blind bot purchase

❌ Unrealistic profit expectations

❌ No testing

❌ Over-leveraging

❌ Ignoring risk controls

❌ Following hype

FAQs (User-Focused)

Q1. क्या automated trading profitable है?

Possible, लेकिन strategy & risk dependent।

Q2. Free bots safe होते हैं?

Not necessarily — हमेशा verify करें।

Q3. Indian stock market में automation legal है?

Broker policies & regulations समझना आवश्यक।

Q4. Crypto bots reliable हैं?

Highly volatile environment — caution ज़रूरी।

Q5. Biggest success factor?

Risk management + realistic expectations।

Conclusion (Trust-Focused Takeaway)

2026 में automated trading software financial markets का महत्वपूर्ण हिस्सा बन चुका है — stocks, forex और cryptocurrency सभी में। लेकिन automation को “easy money machine” समझना सबसे बड़ी गलती है। Software केवल execution tool है; success strategy quality, market understanding और disciplined risk management पर निर्भर करती है।